HIGHLIGHTS

Local Markets

- HY2024 Performance:

- TTCI ↓ 7.1%

- All T&T ↓6.0%

- CLX ↓ 10.9%

- Performance Drivers:

- Cooling inflation

- Resilient Earnings

- Weak Investor Sentiment

- Outlook:

- Economic Normalization

This week, we at Bourse recap the performance of local stock market for at the halfway point of 2024 (HY2024). Despite generally improving earnings, local equity markets have continued a multi-year slide, dampened by weaker investor sentiment and other drivers. Will the local market continue its downward momentum or could new developments and/or shifts in investor sentiment alter their course in the upcoming months? We discuss below.

Local Markets Lower

Continuing a decline which started in 2022, all major indices on the Trinidad and Tobago Stock Exchange (TTSE) closed HY2024 lower. The All Trinidad and Tobago Index (All T&T) fell 6.0% in HY2024. The Cross-Listed Index (CLX), which includes some of the top publicly traded regional firms, contracted 10.9% for the period. As a result, the Trinidad and Tobago Composite Index (TTCI), which measures the performance of all 25 ordinary stocks listed on the First-Tier market, retreated 7.1%.

Major Movers

Prestige Holdings Limited (PHL) led gains at the half-year point, advancing 38.1% supported by higher margins and revenue growth. Ansa McAL Limited (AMCL) gained 14.7% on improving earnings and ongoing acquisition activity, while National Flour Mills Limited (NFM) increased 10.8% due to improved profitability. These three stocks were the only major gainers, with Agostini’s Limited (AGL) advancing just 0.4% while L.J. Williams Limited, “A” (LJWA) remained unchanged.

Major decliners for HY2024 included Trinidad and Tobago NGL Limited (NGL ↓ 36.3%), National Enterprises Limited (NEL ↓ 19.3%), NCB Financial Group Limited (NCBFG ↓ 19.1%), Guardian Media Limited (GML ↓ 18.6%) and Angostura Holdings Limited (AHL ↓ 18.0%).

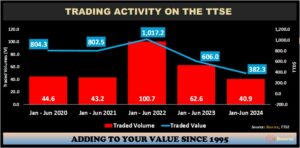

Trading activity on the Trinidad and Tobago Stock Exchange (TTSE) for the period January to June 2024 registered a volume of 40.9M shares, with a traded value of $382.3M.

Massy Holdings Limited (MASSY) dominated trading by volume, accounting for 31.7%, followed by JMMB Group Limited (JMMBGL). In the current review period January – June 2024, trading activity represented a decline in both traded volumes and values over the prior comparable period, falling 34.7% and 36.9% respectively from 62.6M shares and $606.0M in value. January-June 2023 also declined in traded volume and value relative to the prior comparable period in 2022 (100.7M shares and $1.02B).

Most Sectors Lower

The Banking sector, which constitutes 55% of the total index value on the TTSE, experienced a decline of 8.0% in market capitalization in HY2024 (January-June 2024). Other sectors recording declines over HY2024 included Energy (-36.3%), Non-Banking Finance (-13.0%), Manufacturing I & II (-11.4%) and the Conglomerate sector (-0.4%). Conversely, the strongest performance was recorded by the Trading sector, reflecting growth of 4.4% in HY2024. Overall, stock market capitalization fell by 7.1% YTD to $107.5 billion.

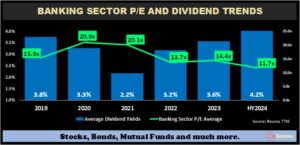

The repricing of equity markets has brought about a general improvement in valuations on offer across most sectors, most notably the Banking sector.

The Banking sector currently has an average dividend yield of 4.2%, with an average P/E ratio of 11.7 times. This compares favourably to its recent historical levels, which would have had an average dividend yield of 3.2% and a P/E multiple range of 13.7 times to as high as 20.9 times during the period 2019-2023. For investors seeking income to accompany the opportunity for capital growth, stocks in this sector including First Citizens Financial Group Holdings Limited (FCGFH), Republic Financial Holdings (RFHL), FirstCaribbean International Bank (FCI) and Scotiabank Trinidad and Tobago (SBTT) currently offer dividend yields of 5.1%, 4.5%, 4.8% and 4.4% respectively. FCI offers the additional advantage of dividend payments in US dollars.

Conglomerates: Accounting for roughly 21.3% of total market value, the conglomerate sector currently trades at an average dividend yield of 3.2% and P/E ratio of 14.1 times. Stocks in the industry achieved generally positive performance led by increased acquisition activity, revenue growth and resilient margins.

Manufacturing I & II: offers a current average dividend yield of 3.3% with a P/E ratio of 11.4 times. Companies within this sector continue to achieve robust earnings and increased revenue growth by implementing cost management initiatives despite higher operating costs.

Trading: The sector has an average dividend yield of 3.3% with a P/E ratio of 17.9 times, continue to deliver strong revenue and earnings growth, largely attributable to Prestige Holdings Limited.

Non-Banking Finance: accounted for (11%) of total market value, with a sector average dividend yield of 5.2% and P/E ratio of 13.6 times.

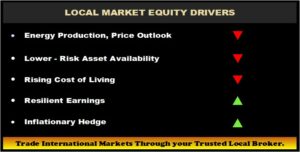

Despite generally resilient earnings, local market performance and activity has remained lacklustre year-to-date. This may be attributable to several factors ultimately influencing investor sentiment, including:

- Energy production and prices. For the period from January to March 2024 – domestic Natural Gas and Crude Oil production averaged 2.6 billion cubic feet per day (bcfd) (-2.4% year-on-year) and 49.9 thousand barrels of oil per day (bopd) (-11% year-on-year) respectively. With T&T’s broader economic fortunes still reliant on energy revenue, subdued production and prices could weigh on sentiment.

- Lower-risk asset availability. Particularly for institutional investors (including asset managers, mutual funds, pension funds, credit unions etc.), the increasing availability of Government of the Republic of Trinidad & Tobago (GORTT) and corporate bond issues – offering relatively attractive fixed rates of return – may be shifting portfolios away from equities and into lower-risk, fixed income instruments in an uncertain environment. In the case of individual investors, the interest in NIF2 launched earlier in 2024 suggests that investors may be favouring the predictability of returns offered by bonds and other fixed rate instruments, as opposed to the greater levels of risk associated with investing in equities (even with attractive dividend yields). This change in preference could be likely reinforced by the declines across local equity markets in 2022 and 2023.

- Cost of living increases. Notwithstanding an increase in the minimum wage, a prolonged period of inflationary pressures in the post-COVID era across both food and core inflation components may be resulting in lower demand by individual investors for equity investments. With lower disposable income and/or the need to draw down on savings, individual investors are more likely to look at trimming the equity component of their portfolios.

Are Equities Still Attractive?

The combination of stock price correction and resilient earnings continue to offer better value for potential equity investors, despite the uncertainty pervading the macroeconomic environment.

When it comes to investment assets, equities tend to be more effective as an inflationary hedge when compared to fixed income alternatives (bonds etc.). This is due to the ability of (most) companies to filter increased input costs through to consumers, in addition to owning real assets such as real estate which also tend appreciate in inflationary environments.

As mentioned, earnings growth remains resilient for many major companies listed on the TTSE. For the investor with a higher risk tolerance and longer-term investing horizon, consider focusing on stocks with (i) more attractive valuations including lower price-to-earnings (P/E) multiples, (ii) above-average dividend yields and (iv) diversification of business by activity and/or geography. Maintaining a value focus-objective when selecting stocks locally remains a useful investing approach.

As always, it makes sense to have a conversation with an experienced investment advisor – like Bourse – to help in making the most informed investment decisions.

“This document has been prepared by Bourse Securities Limited, (“Bourse”), for information purposes only. The production of this publication is not to in any way establish an offer or solicit for the subscription, purchase or sale of any of the securities stated herein to US persons or to contradict any laws of jurisdictions which would interpret our research to be an offer. Any trade in securities recommended herein is done subject to the fact that Bourse, its subsidiaries and/or affiliates have or may have specific or potential conflicts of interest in respect of the security or the issuer of the security, including those arising from (i) trading or dealing in certain securities and acting as an investment advisor; (ii) holding of securities of the issuer as beneficial owner; (iii) having benefitted, benefitting or to benefit from compensation arrangements; (iv) acting as underwriter in any distribution of securities of the issuer in the three years immediately preceding this document; or (v) having direct or indirect financial or other interest in the security or the issuer of the security. Investors are advised accordingly. Neither Bourse nor any of its subsidiaries, affiliates directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses arising from the use of this document or its contents or reliance on the information contained herein. Bourse does not guarantee the accuracy or completeness of the information in this document, which may have been obtained from or is based upon trade and statistical services or other third-party sources. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.”